The Stamp duty holiday is over but houses continue to be more expensive than before?

A question that keeps coming up time and time again...

After a number of conversations with different buyers in Staines we seem to be finding a similar question being asked time and time again. Why are houses still going up? Many buyers were taking an eductated view that after the stamp duty holiday prices would have softened and even paying the dreaded SDLT to HMRC houses should and would be picked up at a better deal. I would of had to agree, if someone had told me last year prices would of continue to grow after the stamp duty holiday had ended considering the amount of transactions and price increases the market saw over this time, I would of said not impossible but unlikely...

The stamp duty holiday is over, well it was over really back in July the £15,000 saving up to £500,000 was reduced to a £2500 saving up until September 30th so a big change to cost of buying property even though we were lucky enough to see it extended! On the grounds that with the number of transactions taking place, the conveyancing process was taken far longer than what we would typically expect, this giving more buyers and sellers the oppurtunity to take advantage.

A usual amount of time for a home once an offer has been accepted is circa 12 or so weeks, great if it can be done before, however we sometimes know with chains these can also go on longer! But 12 weeks being a conservative average, so with this in mind buyer activity should of started to slow down around Feb/March 2021 given average house prices currently and the £15,000 saving looking unachievable. However no signs of any slow down from buyer acitivity and homes in all price bands continued to find new buyers at record prices.

The answer to the most asked question currently within the property market...

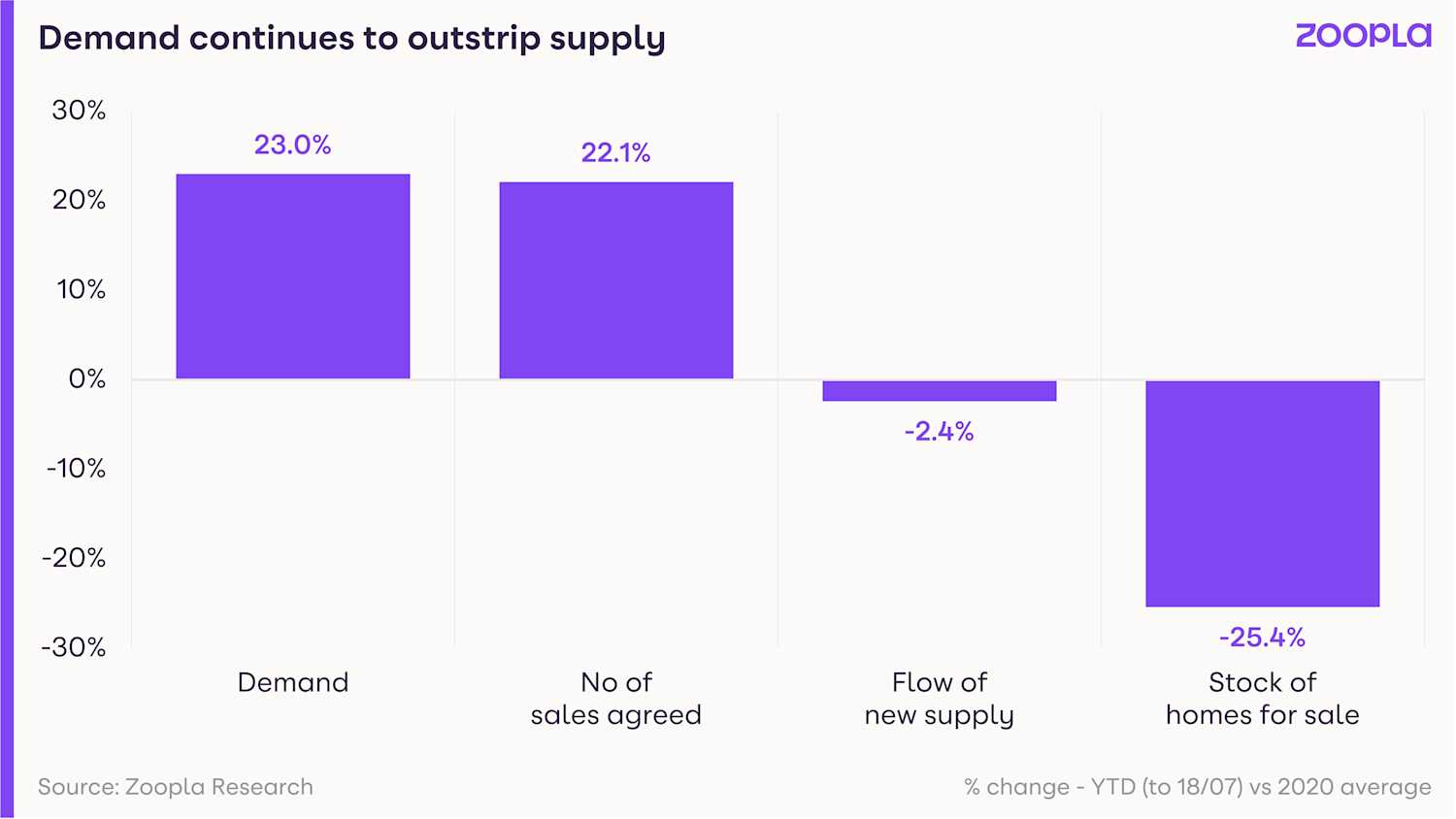

The market to put it in it's simplest form is supply vs demand, there are also a number of other factors that determine the housing market but this one is the most simplest and the most important.

With a huge change in our day to day lives with lockdown even after the SDLT holiday, peoples are spending more time at home than ever before. The desires to change their property has remained strong regardless of any tax savings. In fact buyer activity is up a whopping 23% from around this time last year even with the original tax levys back in place. The biggest factor to the contiuned strong pricing we have seen within the housing market is the sharp turn in the number of houses coming available for sale. The market currently has 25.4% less homes for sale than last year, with demand continuing to grow and the stock failing to replenish this has kept buyers on their toes and continuing to offer record prices and with a 22.1% increase of sales agreed there seems to be an overwhelming number of buyers.

"Why are there so many buyers currently?"

Interest rates are historically low and in fact the lowest we will likely see within our lifetime.

With the fear of interest rates only likely to rise, buyers are swarming to market to secure properties with the cheapest rates at the longest terms possible and compensating sellers to do so.

If you are in need of any advice or have any property related questions feel free to contact Property Owl where one of our agents will be delighted to help on 01784 770686 or feel free to leave your details on our contact us page

Thanks for reading!

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link